Basic IRS Forms and Their Purposes

Basic IRS Forms for Individual Taxpayers

-

Form 1099: This IRS form is used to report payments made to independent contractors, freelancers, or individuals earning non-employment income. It ensures accuracy in income reporting and maintains tax compliance.

-

Form 1040: Individual income tax return. It is used by individuals in the USA to file their annual income tax returns.

-

Form W-2: Wage and Tax Statement. Employers use this form to report employees' annual income and taxes paid to both the employees and the IRS.

Basic IRS Forms for Businesses

-

Form 1120: U.S. Corporation Income Tax Return. Used by C Corporations to file their annual income tax returns.

-

Form 1065: U.S. Return of Partnership Income. Used by partnerships to file their annual income tax returns.

-

Form 941: Employer’s Quarterly Federal Tax Return. Used by employers to report federal income tax, social security, and Medicare taxes withheld from employees' wages.

IRS Forms for Special Situations

-

Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Used by individual taxpayers to extend the deadline for filing their income tax returns.

-

Form 4506-T: Request for Transcript of Tax Return. Used to request a copy of a previously filed tax return.

-

Form W-4: Employee's Withholding Allowance Certificate. Used by employees to inform their employers how much federal income tax should be withheld from their wages.

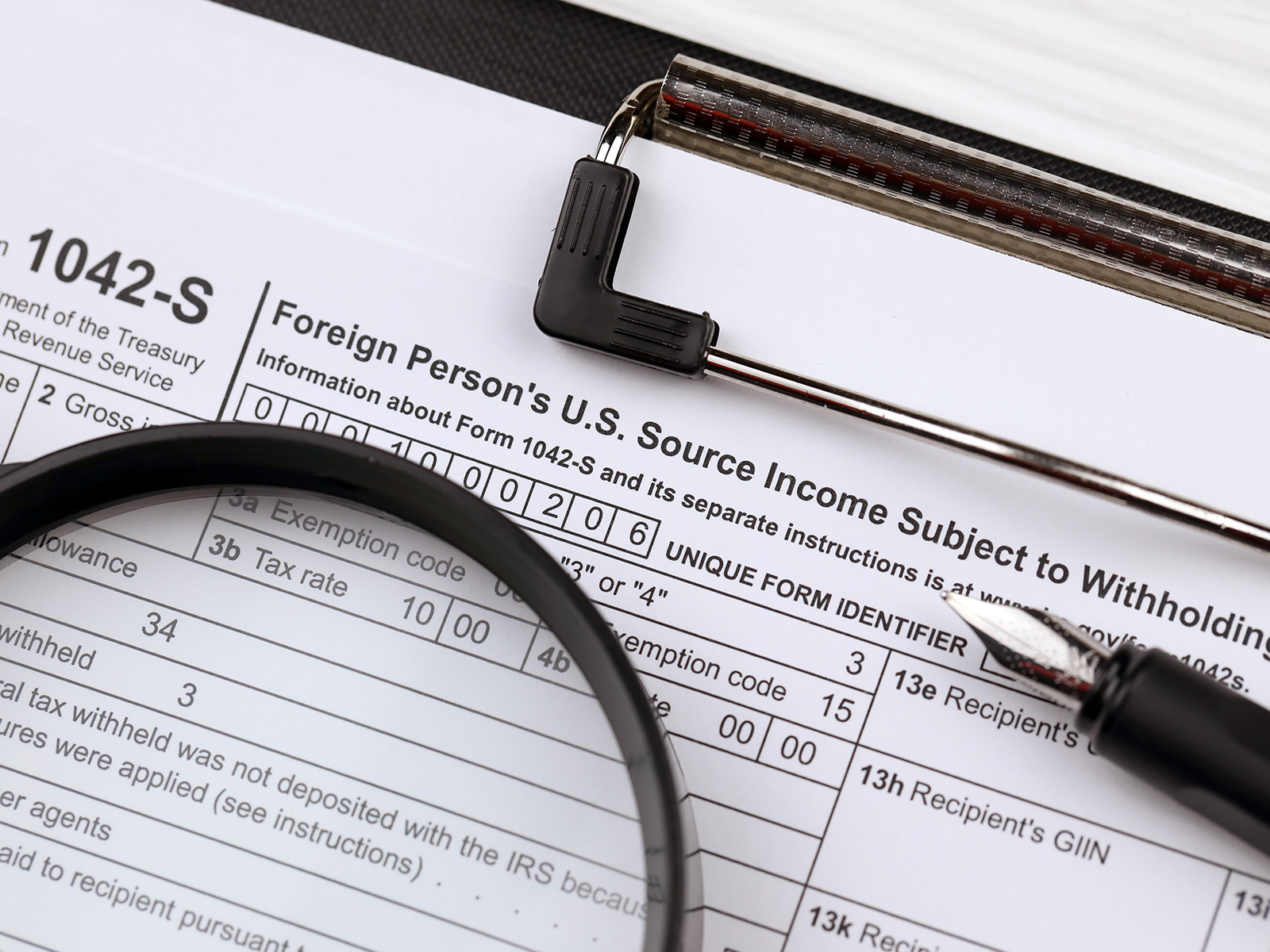

IRS Forms for International Transactions

-

Form 1042-S: Foreign Person's U.S. Source Income Subject to Withholding. Provides information about payments and withholdings made to non-resident individuals in the USA.

-

Form 5471: Information Return of U.S. Persons With Respect to Certain Foreign Corporations. Used to report financial information of foreign corporations controlled by U.S. persons.

Other Important IRS Forms

-

Form 8949: Sales and Other Dispositions of Capital Assets. Used to detail capital gains and losses.

-

Form 720: Quarterly Federal Excise Tax Return. Used to report federal excise taxes on specific goods and services.

These forms are essential for various tax situations and obligations. For more information on the usage and requirements of each form, refer to the relevant IRS resources.